The number of transactions on the Multiple Listing Service® (MLS®) declined in May compared to what is typical for this time of year in Metro Vancouver. This shift has allowed the inventory of homes available for sale to continue to accumulate with over 13,000 homes now actively listed on the MLS® in the region.

The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 2,733 in May 2024, a 19.9 per cent decrease from the 3,411 sales recorded in May 2023. Last month’s sales total was also down 19.6 per cent from the 10-year seasonal average for May (3,398).

“The surprise in the May data is that sales have come in softer than what we’d typically expect to see at this point in the year, while the number of newly listed homes for sale is carrying some of the momentum seen in the April data,” Andrew Lis, GVR’s director of economics and data analytics said. “It’s a natural inclination to chalk these trends up to one factor or another, but what we’re seeing is a culmination of factors influencing buyer and seller decisions in the market right now. It’s everything from higher borrowing costs, to worries about the economy, to policy interventions imposed by various levels of government.”

There were 6,374 detached, attached and apartment properties newly listed for sale on the MLS® in Metro Vancouver in May 2024. This represents a 12.6 per cent increase compared to the 5,661 properties listed in May 2023 and a seven per cent increase compared to the 10-year seasonal average (5,958).

The total number of properties currently listed for sale on the MLS® system in Metro Vancouver is 13,600, a 46.3 per cent increase compared to May 2023 (9,293). This total is also up 19.9 per cent above the 10-year seasonal average (11,344).

Across all detached, attached and apartment property types, the sales-to-active listings ratio for May 2024 is 20.8 per cent. By property type, the ratio is 16.8 per cent for detached homes, 25.1 per cent for attached, and 22.5 per cent for apartment properties.

Analysis of the historical data suggests downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

“With market trends now tilting back toward more balanced conditions, as the number of new listings outpaces the number of sales, we should expect to see slower price growth over the coming months,” Lis said. “Up until recently, prices were climbing modestly across all market segments. But with rising inventory levels and softening demand, buyers who’ve been waiting for an opportunity might have more luck this summer, even if borrowing costs remain elevated.”

Spring inventory continues to build in the Fraser Valley to levels not seen in nearly five years

Slower seasonal sales helped build inventory to its highest level since September 2019 in the Fraser Valley in May, creating more balanced market conditions for home buyers and sellers. The increase in supply over the past several months has further contributed to a softening of price growth, which is good news for buyers.

Active listings increased eight per cent from April to May to 7,904 — up 42 per cent over May 2023 and 19 per cent above the 10-year average.

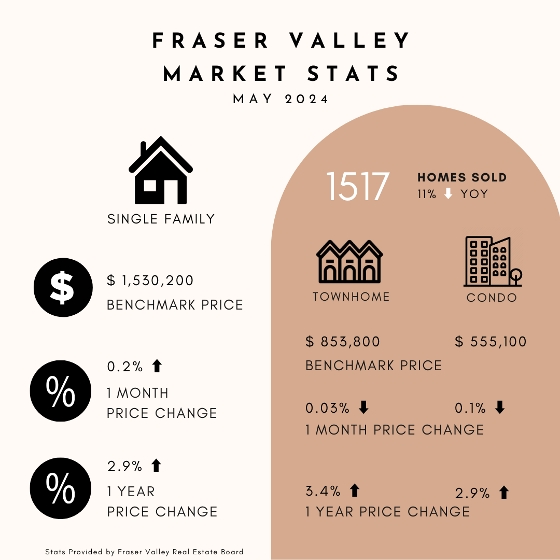

Sales, however, remained seasonally slow, with 1,517 transactions on the Fraser Valley Real Estate Board’s Multiple Listings Service ® (MLS®) in May, up 3 per cent from April, but down 11 per cent compared to May 2023. May sales were 21 per cent below the 10-year average.

“We are seeing an influx of inventory this spring, primarily due to slower than usual spring sales,” said Jeff Chadha, Chair of the Fraser Valley Real Estate Board. “Growing inventory levels are helping to create a healthy balance in the market, giving buyers more options, especially as prices continue to flatten.”

New listings softened in May, down five per cent from April, to 3,760. With a sales-to-active listings ratio of 19 per cent, overall market conditions are balanced. The market is considered balanced when the ratio is between 12 per cent and 20 per cent.

“While the consensus seems to indicate rate cuts in the latter half of the year, there is considerably less agreement about either magnitude or timing,” said FVREB CEO Baldev Gill. “We strongly encourage buyers to have comprehensive discussions with their REALTORS® about market conditions and how they will impact mortgage rates in the coming year.”

The average number of days townhomes and single-family detached homes are spending on the market increased slightly in May. Detached homes are spending 25 days on the market, up from 23 in April. Townhomes are spending 20 days on the market, up one day from April, and condos remain steady at 23 days on the market.

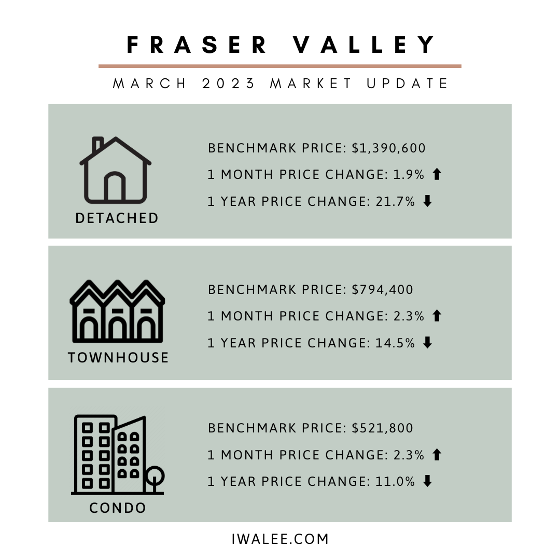

Benchmark prices in the Fraser Valley remained flat in May, with the composite Benchmark price down 0.2 percent from April and down 0.8 per cent from May 2023.

If you are interested in learning about the specific stats of a neighborhood, reach out to Iwa. They can provide insights on areas, property types, or trends you can leverage in 2024.